The End of the Tax Year is Here - Are Your Books Ready?

The 5th of April is creeping up fast, and you know what that means: it’s time to get your financial house in order.

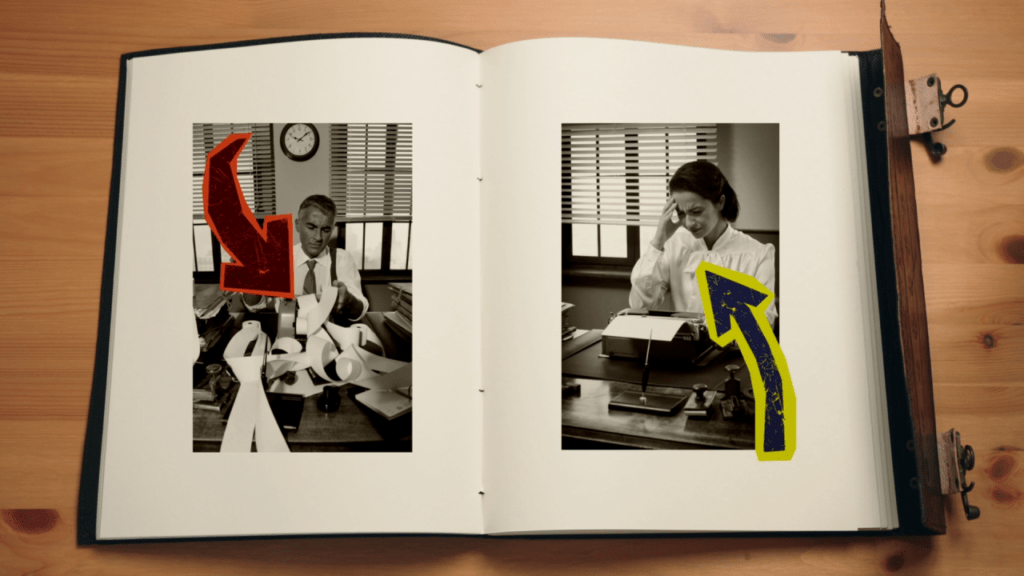

If you’re staring at a pile of receipts, frantically trying to remember what you actually spent that ‘miscellaneous expense’ on, or dreading what your tax bill might look like – take a breath. You’re not alone.

The end of the financial year is one of those things that sneaks up on business owners every single time. But here’s the thing: it doesn’t have to be a last-minute panic. In fact, with the right setup, it could be smooth, simple and stress-free.

Here’s what you need to do right now to make sure you’re not caught off guard – plus how we can help make next year a whole lot easier.

1. Get Your Books Up to Date (Yes, All of Them)

If you’ve been putting off your bookkeeping (don’t worry, we won’t judge), now’s the time to sort it. You’ll need:

✔ All invoices sent and accounted for

✔ Every expense recorded (yes, that coffee ‘meeting’ counts)

✔ Bank statements reconciled

✔ Any outstanding payments chased

If this sounds like a headache, it’s because it is – unless you’ve got an accountant who keeps you on top of things year-round. That’s where we come in.

👉 Explore our bookkeeping services to stay on track all year round.

2. Maximise Tax Deductions & Allowances

Why pay more tax than you need to? The UK tax system actually has plenty of ways for businesses to save money – you just need to know where to look.

Here are some of the key ones to check:

Annual Investment Allowance (AIA): If you’ve bought equipment, software, or other assets, you might be able to deduct the full cost from your profits.

Work-from-home expenses: Even if you occasionally work from the kitchen table, you may be able to claim some costs.

R&D Tax Credits: Developed something new or improved a process? You could be due a tax break.

The problem? Most small business owners don’t have time to figure all this out. We do.

👉 Check if you’re missing tax relief opportunities in our latest guide.

👉 Or get help directly with our tax compliance and planning services.

3. Plan Ahead for Next Year (So You’re Not in This Mess Again)

Imagine this: Instead of scrambling every March, your books are always up to date. You know exactly where your money is, how much tax you’ll owe and what’s coming up next.

That’s how it should be – and that’s what Xolve does.

We don’t just tidy up the mess at the end of the year. We keep you in the loop all year round, so tax season isn’t something you dread.

✔ Automated bookkeeping – so you’re never behind

✔ Real-time financial insights – so you always know where you stand

✔ No surprises – so you can actually plan for the future

Want to Get Sorted Before the Deadline? Let’s Talk.

If your books are a disaster zone and the 5th of April is starting to feel very close, we’ve got you. Xolve can help you get sorted – fast.

And if you want next year to be a breeze, it’s time to stop firefighting and start running your business with financial clarity.

👉 Book a free MTD Readiness Check

👉 Or get in touch and let’s make your books boringly perfect – so you can focus on the more exciting stuff.