Not Your Typical Accounting Firm

Forget stiff suits, neverending spreadsheets and confusing jargon – this is accounting, reimagined.

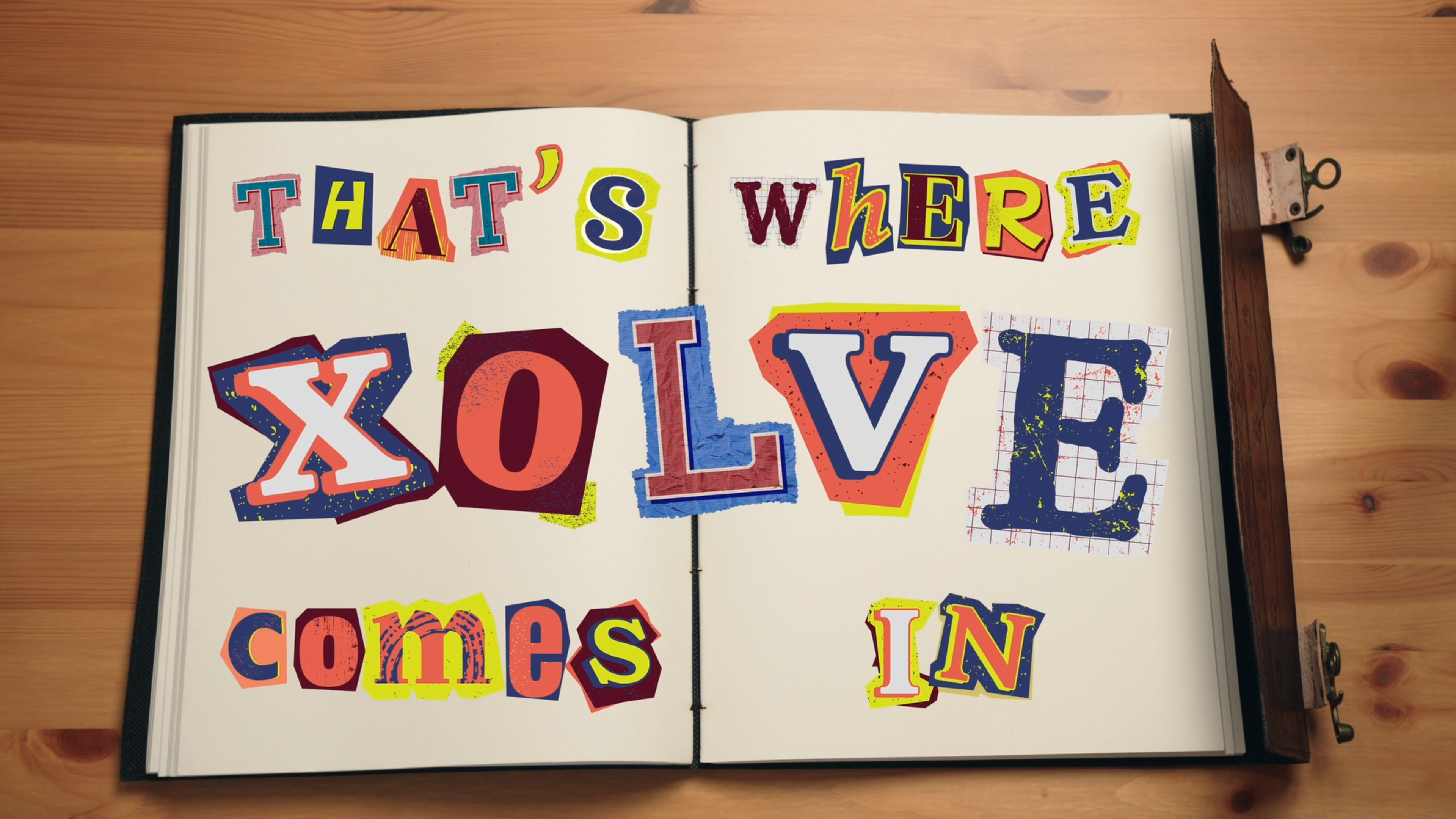

Xolve: It’s Simple Because It Should Be

Accounting doesn’t need to be intimidating, boring or shrouded in complexity. At Xolve, we believe managing your finances should feel effortless – like it’s happening in the background. Whether you’re a business owner, freelancer or contractor, we remove the stress, so you can put your energy where it counts.

What We Stand For

Clarity

No jargon, no waffle, no surprises. Just clear answers and real results.

Efficiency

Smart tools and streamlined processes that save you time and energy.

Kindness

No stiff suits or intimidating conversations – just real people, ready to help.

Progress

Tools and insights that keep you ahead of the curve in an ever-changing financial world.

Sue Blaeford – The Brain Behind Xolve

With over 20 years of experience, Sue has lived through every stage of accounting – from balancing ledgers by hand to embracing the latest digital tools. She’s spent decades perfecting what works (and ditching what doesn’t), always keeping her clients’ needs front and centre. Sue’s mission is simple: to make managing finances as stress-free as possible while never losing the personal touch.

Richard Metcalfe – The Vision Behind the Numbers

As a seasoned fintech founder, Richard has spent years transforming outdated systems into seamless experiences. His previous startup was one of the first to be recognised for HMRC iXBRL filing in 2009, building plug-ins for leading accounting packages and thousands of blue-chip businesses. In 2019, he launched a Making Tax Digital software package, staying ahead of industry shifts. With Richard at the helm of Xolve’s tech approach, you get processes that work like clockwork – faster, smarter and hassle-free.

How We’re Different

Xolve isn’t your typical accounting service – it’s a smarter way to manage your finances. By blending traditional values with modern solutions, we deliver efficiency without losing the personal connection. We believe in clarity, simplicity, and giving you the tools and insights to make informed decisions – all without the usual headaches.

Making Tax Digital – What You Need to Know

The days of paper tax returns are numbered. HMRC’s Making Tax Digital initiative is rolling out across businesses, requiring digital record-keeping and online submissions. If that sounds like a headache, don’t worry – we’ve got it covered.